A contribution margin income statement deducts variable expenses from sales and arrives at a contribution margin. Fixed expenses are then subtracted to arrive at the net profit or loss for the period. For that, you’ll need a tool that automates data collection, accurately calculates financial insights, and produces customizable contribution margin income statement reports. Request a free demo and see how Cube can help you save time with all your contribution margin income statements, reports, analysis, and planning. You can’t directly calculate the contribution margin from the EBIT figure, without a breakdown of the fixed and variable costs for each product or service.

Contribution Margin Analysis Per Unit Example

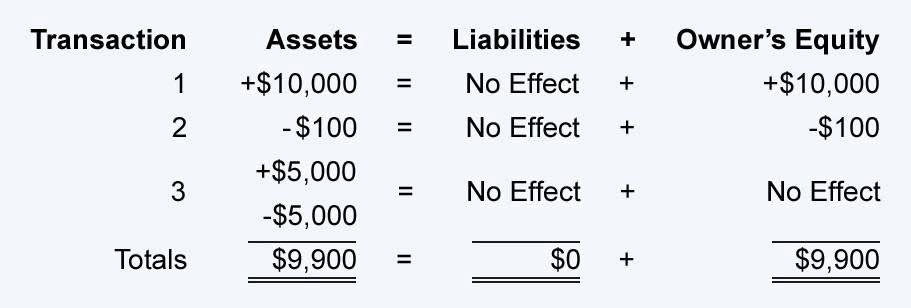

While contribution margins only count the variable costs, the gross profit margin includes all of the costs that a company incurs in order to make sales. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue. The contribution margin represents the amount of revenue left over after subtracting variable costs from total revenue.

Costs at Lowe’s Companies, Inc

This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. Remember the format and ignore the traditional (absorption) income statement.

- Fixed cost refers to all costs incurred by the company that does not change with the company’s level of output, i.e., they remain constant regardless of the company’s level of output.

- Second, variable selling and administrative expenses are grouped with variable production costs, so that they are part of the calculation of the contribution margin.

- Do these labor-saving processes change the cost structure for the company?

- Variable costs, no matter if they are product or period costs appear at the top of the statement.

- Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company.

- The two expense categories may contain both fixed and variable costs, which is why it can be useful to separate them using a contribution format statement.

How to Determine Your Contribution Margin Income

The financial data used to create these have a lot of crossovers, but they look at different aspects of a business. You might have been thinking that the contribution margin sounds like EBIT or EBITDA, but they’re actually pretty different. Going back to that beauty company example from earlier, we’ll assume the business has expanded into the high-end skincare market and wants to see how the new line is performing financially. That is, it must generate a certain amount of revenue in order to cover its expenses.

As we said earlier, variable costs have a direct relationship with production levels. Traditional income statements are used to evaluate the overall profitability of a business. Contribution formats are more detailed, and are useful for evaluating business segments, such as subsidiaries or divisions, or individual product lines. They’re also useful for managers determining how sensitive variable costs are to a change in sales or production. Instead, management must maintain a certain minimum level of staffing in the production area, which does not change with lower production volumes. The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period.

Different margins

- A low margin typically means that the company, product line, or department isn’t that profitable.

- Contribution margin income statements refer to the statement which shows the amount of contribution arrived after deducting all the expenses that are variable from the total revenue amount.

- Therefore, the contribution margin reflects how much revenue exceeds the coinciding variable costs.

- Pay no monthly fees, get payouts up to 7 days earlier, and earn cashback on eligible purchases.

- As you can see, this format is very different from the traditional income statement format because cost of goods sold is not listed and gross margin is not calculated on the report.

- For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage.

- Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. To calculate sales, take the price of the product and multiply by the number of units sold.

- Before making any major business decision, you should look at other profit measures as well.

- Unlike a traditional income statement, the expenses are bifurcated based on how the cost behaves.

- It’s also a cornerstone of contribution margin analysis, giving enormous insight into a business’s overall financial position.

- If your product revenue is $500,000 and your total variable expenses are $250,000, your contribution margin is $250,000 $500,000, or 50%.

- In such cases, the price of the product should be adjusted for the offering to be economically viable.

- This is the net amount that the company expects to receive from its total sales.

- For example, while production materials are variable costs, equipment depreciation is fixed.

Contribution margin income statements: a complete guide

Management uses this metric to understand what price they are able to charge for a product without losing money as production increases and scale continues. It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.

Most students that have trouble with this statement try to relate it back to what is happening on the traditional income statement. Throw out what you know about the traditional income statement when doing the contribution margin income statement. Add fixed overhead and fixed selling and administrative to calculate total fixed cost. In the absorption and variable costing post, we calculated the variable product cost per unit. The contribution margin income statement is a very useful tool in planning and decision making. While it cannot be used for GAAP financial statements, it is often used by managers internally.

Retail companies like Lowe’s tend to have higher variable costs than manufacturing companies like General Motors and Boeing. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company? The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage.